for eCommerce Sellers

File your GST return in under 2 minutes.

No more manual Excel work—save up to ₹40,000/year and avoid costly errors.

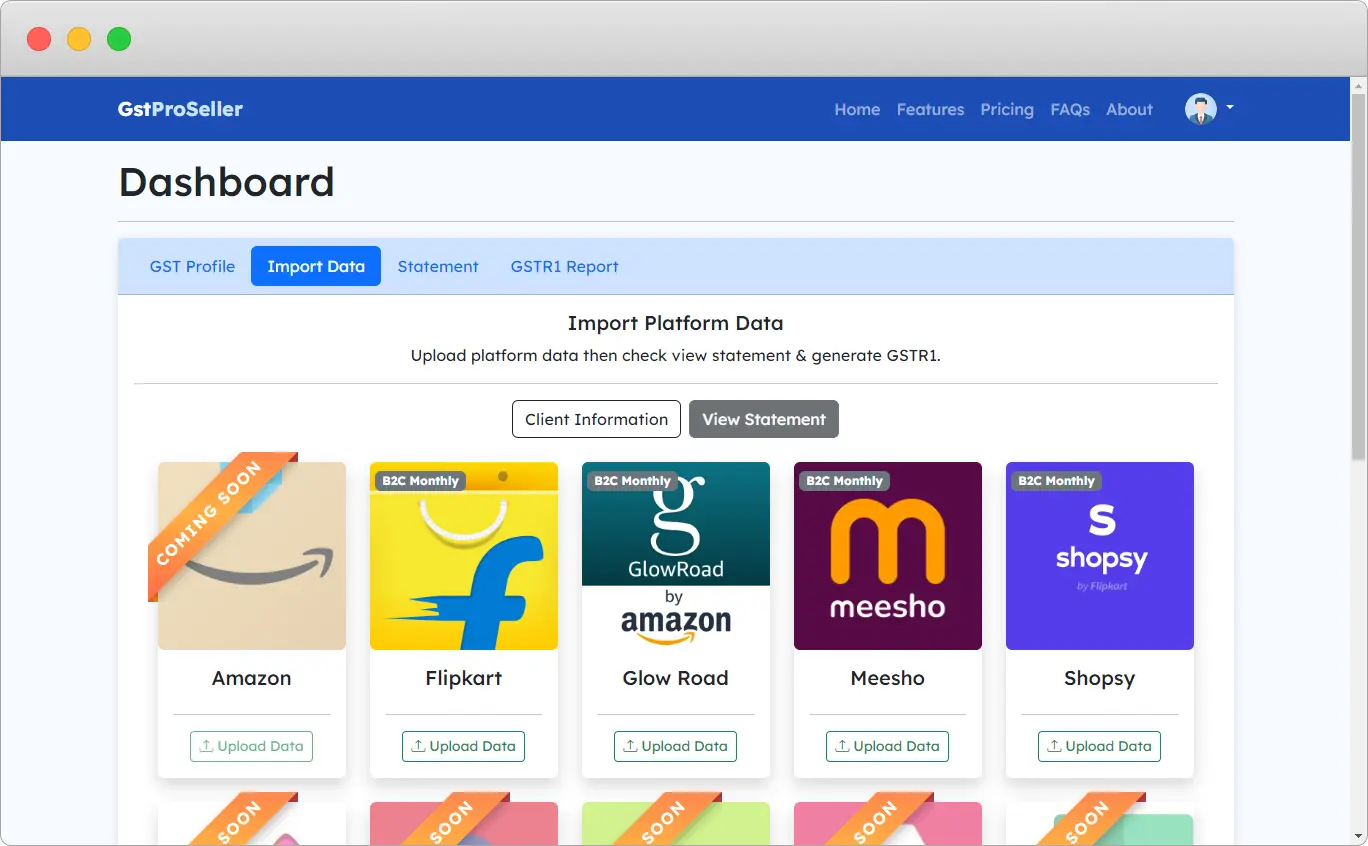

- Import sales from Amazon, Flipkart, Meesho & more

- Instant GSTR-1 Excel & JSON reports

- No accounting knowledge required

Supported Platforms

#AtmaNirbharBharat

Join a thriving community of 10,000+ smart eCommerce sellers and accounting professionals who trust GSTProSeller to file their monthly GST returns accurately and effortlessly.

How Does the Tool Work?

Simply follow four steps to generate GSTR-1

Create Profile

Add client profiles to efficiently manage their information, streamlining and accelerating the GST filing process.

Upload Data

Select the return period and upload your data to the corresponding portal.

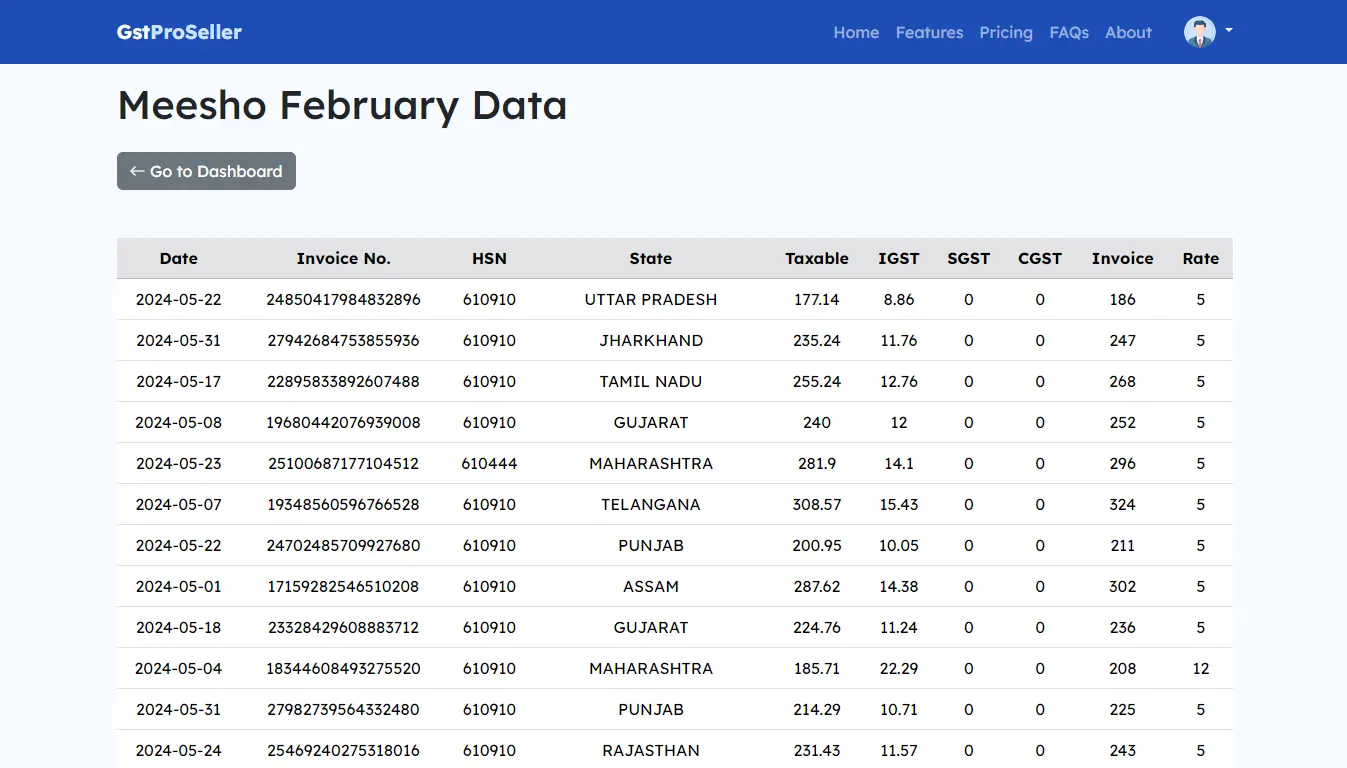

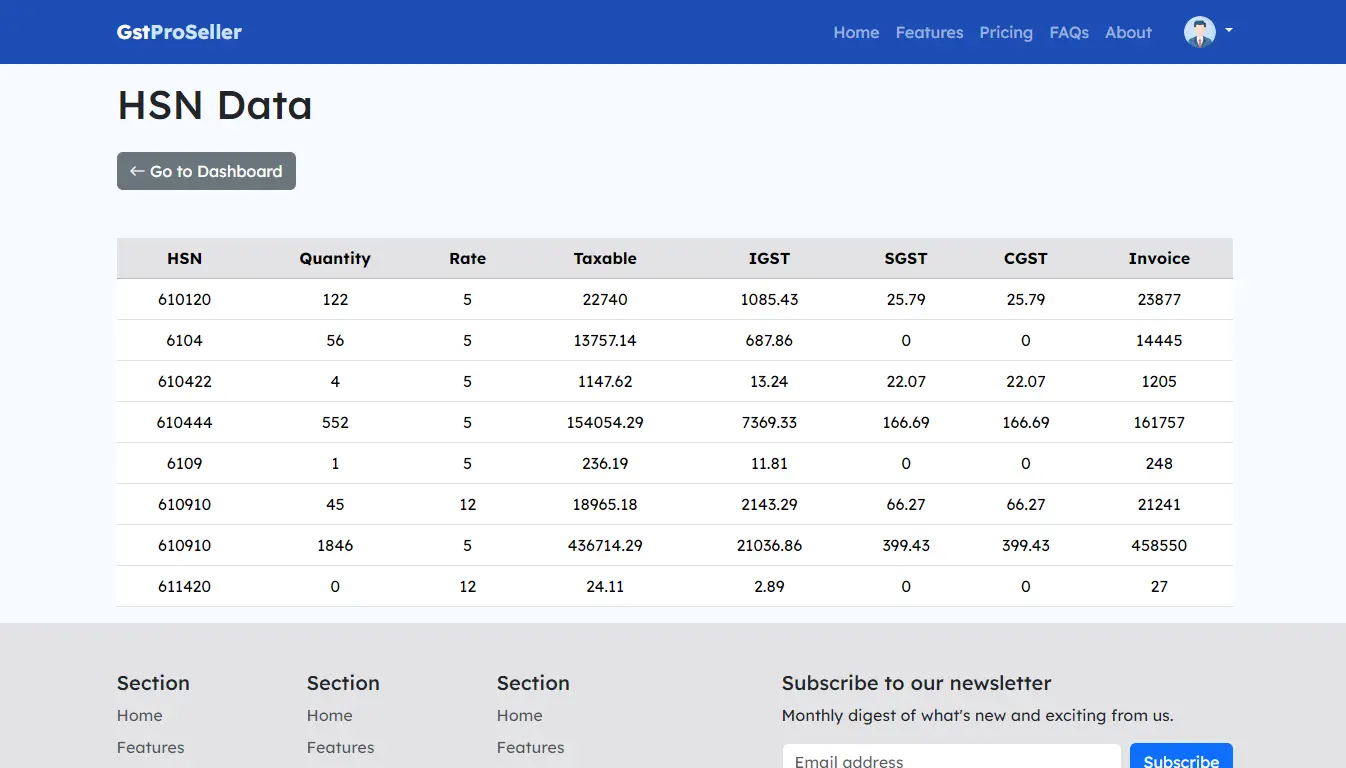

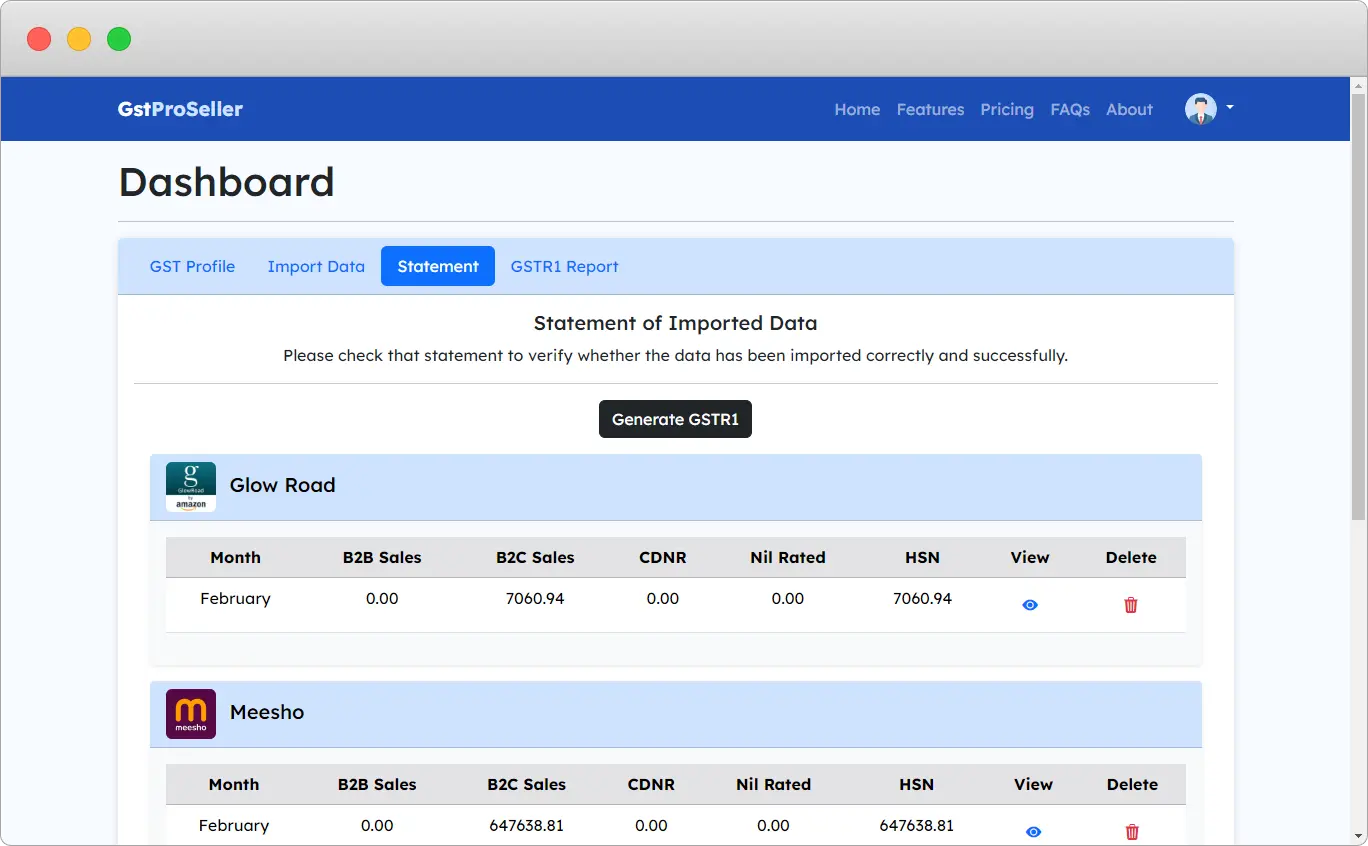

Generate GSTR-1

Generate the GSTR-1 and cross-check the data with TCS records.

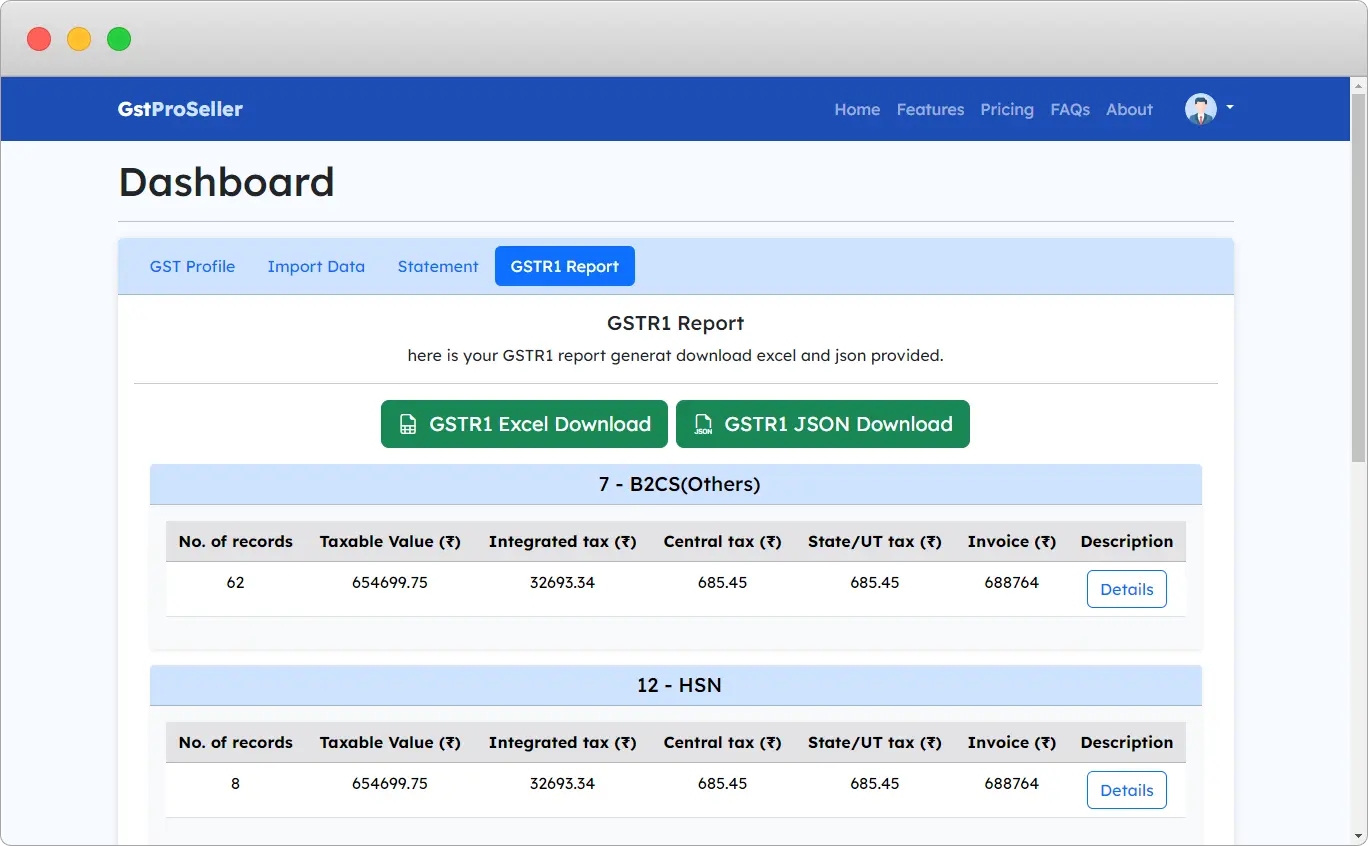

Download Report

Download the GSTR-1 Excel and JSON files, then upload them to the GST portal.

Take charge of your GST compliance by automating the GSTR-1 filing process—no accountant required. Our platform helps you save money, gain essential tax knowledge, and master business management skills. We believe every small business owner deserves the confidence and tools to grow sustainably in today’s competitive landscape.

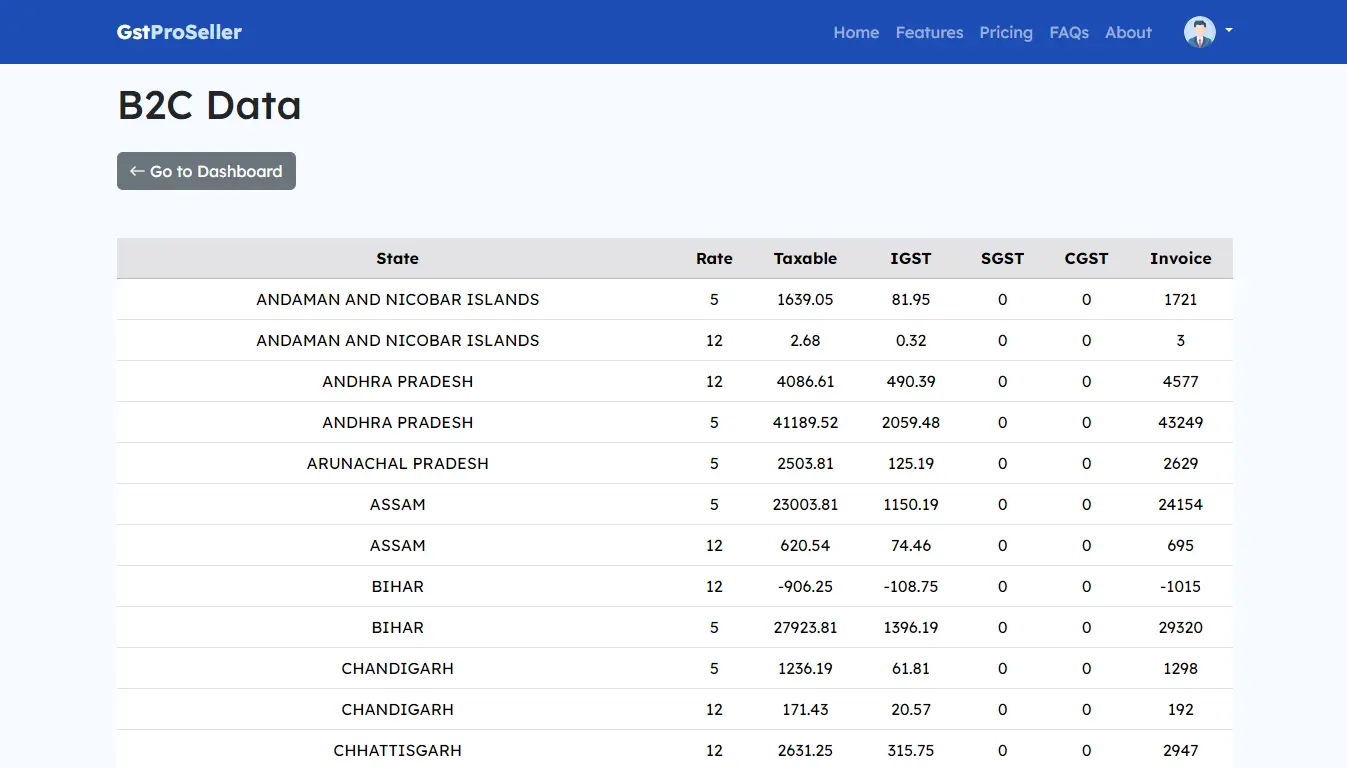

Get comprehensive information

Your complete solution for hassle-free GSTR-1 compliance

Need Help?

Our support team is here to assist you with any questions or issues you may have.

Send Us an Email

Reach out to our support team via email for prompt assistance.

Email: support@gstproseller.com

Request a Callback

Provide your contact details, and our team will call you back at your convenience.

Schedule a Free Demo

Book a free demo to see how GSTProSeller can help your business.

Frequently asked questions

If you can’t find what you’re looking for, email our support team and if you’re lucky someone will get back to you.